Property tax notices are now on their way to all Key City residents and businesses.

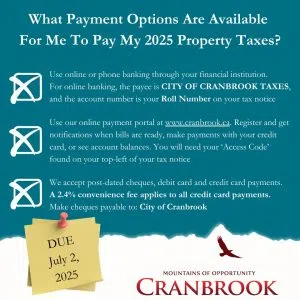

You can pay by phone or online through most banking institutions with the payee “CITY OF CRANBROOK TAXES”. The account number is your roll number found on the notice.

If you’re looking to pay at City Hall, non-cash payments like debit, credit and post-dated cheques are preferred.

Homeowner Grant applications are not accepted at City Hall and can only be claimed in person at the Service BC office (100 Cranbrook Street North). You can also apply online through the Service BC website or by phone at 1-888-355-2700.

10 per cent penalties will be applied after the tax deadline on Wednesday, July 2.

If your notice hasn’t arrived by the second week of June, the City of Cranbrook asks you to call 250-489-0233 to get a copy as soon as possible.

Comments